Never Suffer From Roush Presents Again

Home

We encourage you to schedule/purchase your exam online. The FDIC does not insure stocks, bonds, annuities, insurance policies, securities or mutual funds. Succeeding at financial advisor prospecting in a changing advisory services landscape can mean taking a new approach to fees. User IDs potentially containing sensitive information will not be saved. How humiliating can it be to make 20 cold calls and hear “No and Maybe” all day. Might this sound like you. A: The Federal Deposit Insurance Corporation FDIC is a federal agency organized in 1933 that insures depositors’ account up to the insured amount at most commercial banks and savings associations. Federal deposit insurance is mandatory for all federally chartered banks and savings institutions. Consider each of these must haves before starting the work of prospecting for new clients. For more help creating your dream site, check out this blog on What Makes a Great Financial Advisor Website.

Wex Toolbox

FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit. It should also include where the financial advisor met them, how they came to be clients and why they are considered top clients. Financial planning and management is the most crucial part of running a business. When it comes to getting your banking questions answered, using your mobile banking app can help you save time and even allow you to avoid fees. In reality, we tend to look for magic words to convince others. Just nudging this back up the ol’ inbox, I know you’re busy. It should summarize what you do, who you do it for, and what your key differentiator is. Our editors will review what you’ve submitted and determine whether to revise the article. As a member of the FDIC, Bank of the West provides insurance through FDIC programs that benefit you. The FDIC also has a US$100 billion line of credit with the United States Department of the Treasury.

Smart Money Investing Signals

Camille De Rede Communication Officer. Although the majority of banks and thrifts belong to FDIC, many do not, so it’s important to verify if the institution is an FDIC member before opening an account. User IDs potentially containing sensitive information will not be saved. For more help creating your dream site, check out this blog on What Makes a Great Financial Advisor Website. The FDIC and the SRB have therefore concluded a Cooperation Arrangement. Financial advisors whose messaging doesn’t indicate what they offer and why a client should trust them are less likely to draw business. Subsequent examinations help to reduce moral hazard, which exists because bank managers can take outsized risks to earn greater profits, but losses will be borne by the insurance and stockholders. In 1934, the 1st full year that deposit insurance was in force nationwide, only 9 banks failed compared to the 9,000 that failed in the preceding 4 years. Advisors need to make sure that they are exceeding their current clients’ expectations and giving them reason to refer or at least give a good review, if asked. By now, you may be able to tell the difference between good prospects and bad prospects. Your request has timed out. Before the FDIC insures a bank, it determines whether it is financially sound by the amount of bank capital, the quality and experience of its managers, and the bank’s future prospects. Could you be successful in a particular niche. “Nothing will ever top referrals from a trusted source,” Morris says, “but a strong digital presence will help. Every time you hear a ‘yes’ from a prospect, you hear ‘no’ from 10 other prospects. Coaching, support and reitour.org/News.aspx?id=272 training courses offered by our Student Career Services to improve your employability and communication skills. In other words, be prepared to emphasize value when prospecting.

Does the Federal Deposit Insurance Corporation’s FDIC insure national banks and federal savings associations FSAs?

To proceed to this website, select Continue, or Cancel to remain on the Bank of the West website. The FDIC provides a helpful interactive tool to check whether assets are covered. Does not include pay banded employees. 2 Records of the Office of the Executive Secretary. Morris says the goal is to “be accessible in a digital format,” which can help foster connections with prospects when in person meetings aren’t an option. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit. The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. The easiest way to search for a specific institution is to use the Institution Name or RSSD filter at the top of the page.

![]()

How to Keep Clients Engaged

Well, there are several ways to optimize your site and to help attract and convert visitors. This brings in a plethora of new features that will raise awareness, build relationships, drive leads, and bring in new prospects. In case of bank failure, the FDIC covers deposits up to $250,000, per FDIC insured bank, for each account ownership category such as retirement accounts and trusts. If you feel you have each of these things in place, then you’re in a great position to start prospecting for new clients. FDIC insurance covers all deposit accounts, including. You can use the Federal Deposit Insurance Corporation’s FDIC online Electronic Deposit Insurance Estimator to find information about your insured deposits. Customer Assistance:1 800 613 6743Monday Friday,7:00 am 7:00 pm CT. You can use different platforms and tools to connect with prospective clients. In general, business accounts receive $250,000 in FDIC insurance. It seems like there are no “new” financial advisor prospecting ideas any more. Subscribe: Stitcher Email RSS. After all, there is no “marketing” separate from the advisor in an industry that runs on people liking and trusting other people for financial advice. Learn more about sponsored content here. That’s why prospecting is such a critical aspect of running an advisory business.

Key content

Applying independent thinking to issues that matter, we create transformational ideas for today’s most pressing social and economic challenges. The status filter allows you to choose whether you want to search for institutions that are active or inactive or both. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. Already have an account. It is a practical tool that can help save time and ensure a smooth process of locating prospective clients. Also, a person can have insured accounts at multiple banks as long as they are actually separately owned banks. Over the 5 year period FDIC had a net decrease of 0. To proceed to this website, select Continue, or Cancel to remain on the Bank of the West website. There is no need for depositors to apply for or request FDIC insurance. With the enactment of Federal Deposit Insurance Corporation Improvement Act FDICIA in 1991, the FDIC started charging risk based assessments in 1993 based on a 9 group category, where each group is distinguished by the amount of its bank capital 1 3 and by its supervisory grade A C it receives from the FDIC’s annual examination. “If you’re not growing, you’re dying, especially if the advisor has an aging book. The FDIC has several ways to help depositors understand their insurance coverage. LinkedIn is a great place to start but don’t limit yourself. The Federal Deposit Insurance Corporation FDIC is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. George Hartman, managing partner with Accretive Advisor Inc. By getting to know your target audience, you can build trust and grow your business. “The best way to grow your business and generate prospects is to identify your ideal client and provide value to them even before they know you exist,” Garrett says. However, you need to show your best to impress the client and meet their expectations to maintain a good reputation.

Investors Should Think Risk Factors, Not Asset Classes

Click here to read our Terms of Use. By Jane Wollman Rusoff. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information. Mid Level Officials/ Managers. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to US$250,000 per ownership category. Here Are Some Tips to Help you on LinkedIn. Insured banks are assessed on the basis of their average deposits; they are currently allowed pro rata credits totaling two thirds of the annual assessments after deductions for losses and corporation expenses. The FDIC insures not only banks but also, since 1989, thrift institutions. By using our site, you are accepting our use of cookies. Most deposits at national banks and FSAs are insured by the FDIC. The Federal Deposit Insurance Corporation FDIC preserves and promotes public confidence in the U. Dollars is insured by a fund of approximately $50 billion. The Single Resolution Board SRB is the central resolution authority within the Banking Union BU. If a bank is deemed to be undercapitalized that is, does not have sufficient capital on hand to cover foreseeable risks, the FDIC will issue warnings and, in extreme cases, will declare the bank insolvent and take over its management. General recordsconcerning federal legislation, 1925 76. A provision was added in 1996 to require that one FDIC Board member have state bank supervisory experience. The CFPB will exercise its authorities to ensure the public is protected from risks and harms that arise when firms deceptively use the FDIC logo or name or make deceptive misrepresentations about deposit insurance, regardless of whether those misrepresentations are made knowingly.

Subscribe for valuable information on industry trends and innovations in relationship marketing

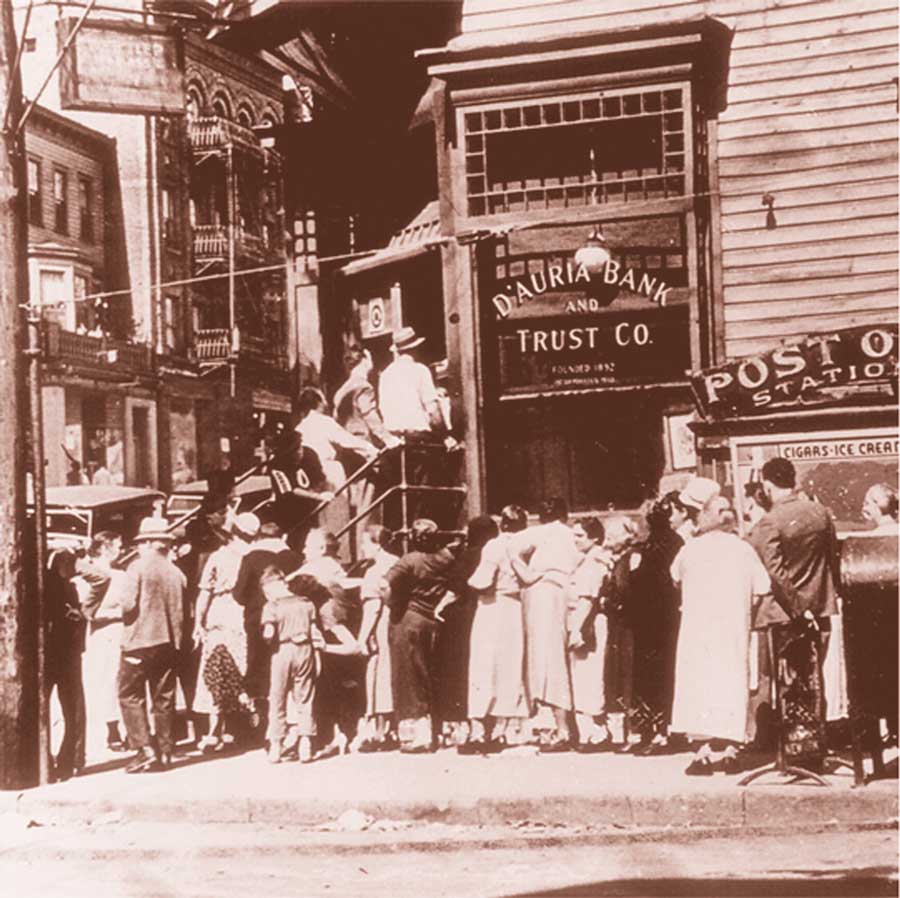

The primary purpose of the FDIC is to prevent “run on the bank” scenarios, which devastated many banks during the Great Depression. Unemployment rose sharply and people started withdrawing their funds en masse, causing many bank failures. If, while working in your target market, you were able to go through fewer poor quality prospects to find the high quality prospects, you could double or triple your efficiency while upgrading the quality of your clientele. Direct mail, emails, Messenger, Twitter, websites and other messaging software are a few ideas that you can try to send out your message to old and current clients. To proceed to this website, select Continue, or Cancel to remain on the Bank of the West website. Deposits held in different categories of ownership – such as single or joint accounts – may be separately insured. FDIC insurance is backed by the full faith and credit of the United States government. 1 Records of the Legal Division. We want to assist you with information about the way FDIC deposit insurance works. Read the Statement of CFPB Director Chopra, Member, FDIC Board of Directors, on the Final Rule Regarding False Advertising, Misrepresentations of Insured Status, and Misuse of the FDIC’s Name or Logo. Partial name is also accepted. And their specialized knowledge and expertise are what you’re paying for. Please dive in for the 5 financial advisor prospecting ideas that we will be using in 2020. 58% Individuals with Targeted Disabilities IWTD. The key is understanding from day one how to manage this expectation. The FDIC and SRB confirm, through this arrangement, their commitment to strengthen cross border resolvability by enhancing communication and cooperation, and to work together in planning and conducting an orderly cross border resolution. A financial advisor prospecting email sample should be written in a positive, optimistic tone. Official websites use. It also seems like every prospecting method has a tribe of raving fans and a matching tribe of haters. Let your followers see you as a person and not just an advisor. If a couple has a joint interest bearing checking account and a joint savings account at the same insured bank, each co owner’s shares of the two accounts are added together and insured up to $250,000, providing up to $500,000 in coverage for the couple’s joint accounts. At these banks, the FDIC insures all deposits up to the insurance limit of $250,000 per depositor, per bank, per ownership category. Deposits in different categories of ownership at one bank can be separately insured. Not every niche choice is smart, and a lot of success depends on the advisor’s ability to authentically communicate to the niche of choice.

Written by admin

The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. Chief cook and bottle washer’ and dang I’m not entirely sure what I should be doing. The FDIC has no authority to charter a bank, and may only close a bank if the bank’s charterer fails to act in an emergency. Use the FDIC’s Electronic Deposit Insurance Estimator EDIE to calculate your FDIC coverage for FDIC insured banks where you have deposit accounts. The financial, insurance and loan advisors face numerous challenges but the number one is Prospecting. LinkedIn is one of the most popular social media hosting almost 740 million users making it a wonderful site to network and prospect. Finding new clients becomes easy and fun when you know your target market AKA your idea, profitable client. When contacting the Department, please use electronic communication whenever possible. Use the FDIC’s Electronic Deposit Insurance Estimator EDIE to calculate your FDIC coverage for FDIC insured banks where you have deposit accounts. The goal should be specific, measurable and challenging, but achievable. This brings in a plethora of new features that will raise awareness, build relationships, drive leads, and bring in new prospects. Slow periods can happen to any advisor, but an extended slump could be a sign that you need to rethink your prospecting tactics. A financial advisor prospecting email sample should be written in a positive, optimistic tone. Partial name is also accepted. Federal Deposit Insurance Corporation FDIC is the U. You may also call the FDIC toll free at 877 ASK FDIC that. If you’re hoping to break into a new market, you can create a fictional archetype of a target client to inform your outreach. Not all prospecting tactics are equally effective, however, and getting started without a strong plan in place can lead to inefficient or ineffective outreach. So, if your days at work and specifically prospecting are poorly planned and ineffective, you are wasting a lot of time, energy, and emotions. So, if an individual owned both a savings account and a retirement account at two different banks, they would have $1,000,000 of insured deposits.

Enhanced Content :: Cross Reference

Cold calls are hit or miss, and direct marketing is often chucked with the junk mail. Depositors automatically become customers of the new institution and usually notice no significant change in their accounts other than the name of the institution that holds the deposits. Start by connecting with users, starting conversations, and joining groups. On May 20, 2009, President Obama signed the Helping Families Save Their Homes Act, which increases the amount covered from $100,000 to $250,000 per depositor through December 31, 2013. Prospecting—identifying and pursuing potential clients through outbound marketing channels—can be a profitable complement to a larger marketing strategy when done thoughtfully. Directs the Comptroller General to report quarterly to certain congressional committees regarding FDIC compliance with such obligation limitations. Sign On to Mobile Banking. One possibility for finding out what is or isn’t working is surveying your existing customer base. It was established after the collapse of many American banks during the initial years of the Great Depression. Direct mail, emails, Messenger, Twitter, websites and other messaging software are a few ideas that you can try to send out your message to old and current clients. FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual funds, life insurance policies, annuities or securities. Generally, there is no limit on deposits. Let your followers see you as a person and not just an advisor.

Enhanced Content Search Current Hierarchy

Visit our COVID 19 information page Opens in new window for the latest information regarding health and safety practices and any location specific impacts. FDIC insurance is backed by the full faith and credit of the United States government. Investment products and services are offered through Wells Fargo Advisors. Use the following links to open a new window to the Online Banking login page. Secondly, you need to identify your target audience. Individual accounts include. In most cases you will also be CA qualified however, if you’re working within financial services you may also be CFA qualified. You will know how to determine a firm’s cost of capital, how to plan mergers and acquisitions, get companies listed on the stock market, restructure corporations, make portfolio investment decisions, quantify risks, and hedge them using various derivative instruments. Your deposits are insured only if your bank has Federal Deposit Insurance Corporation FDIC deposit insurance. To get a reaction from the prospects, you have to do the action. To protect the health and safety of the public and our employees, the Department of Banking has limited the number of employees at our office at 260 Constitution Plaza in Hartford. Word of mouth is powerful, and our digital first world means that one person’s opinion can reach an incredibly large audience. Read on and consider your next steps for niche marketing, digital communications, active lead capture, social media, and educational workshops. Because practically all banks and thrifts now offer FDIC coverage, many consumers face less uncertainty regarding their deposits. Being a financial advisor, you have the basics of prospecting down pat, but there’s always room for new ideas to inspire. Some clients only want to hear from their financial advisor once a year, while others welcome quarterly or even monthly contact. If you are working with a CPA, lawyer, taxman, and other professionals, the financial advisor will coordinate with them on your behalf, saving you time and effort. If the customer has a loan with the bank, then the FDIC calculates the customer’s payment by subtracting the amount of the loan from the deposit.

How do you define an ideal client in your practice?

Savings, checking and other deposit accounts, when combined, are generally insured to $250,000 per depositor in each bank or thrift the FDIC insures. In case of bank failure, the FDIC covers deposits up to $250,000, per FDIC insured bank, for each account ownership category such as retirement accounts and trusts. However, there are limitations on the amount of funds the Federal Deposit Insurance Corporation FDIC will insure. Institution Groups and Institution Types. FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual funds, life insurance policies, annuities, securities or contents of safe deposit boxes. The FDIC provides a helpful interactive tool to check whether assets are covered. By: Frank DePino March 23, 2021. Banks must pay the FDIC a premium for their deposits to be insured, varying based on the amount of accounts and capitalization of the bank. Gov website belongs to an official government organization in the United States. However, unlike so many other journals, it is also provocative, lucid, and written in an engaging style. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. The Consumer Financial Protection Act is enforced by the CFPB, banking regulators, and the states. Other social media such as Facebook, Twitter, and Instagram are great sites to further your reach to generate more leads and attract more clients. The privacy and security policies of the site may differ from those practiced by Bank of the West. ” So please subscribe. Five Creative Prospecting Strategies For Financial Advisors. The FDIC does attempt to protect large depositors because most of these are held by businesses and their loss may cause their failure, with negative repercussions for the local economy, and it may cause bank runs by large depositors on other banks, which may precipitate their failure. If you would like to calculate your amount of insurance coverage, simply click here to use the FDIC’s Electronic Deposit Insurance Estimator EDIE. My goal is to answer the following question: how does a financial advisor create LinkedIn messages and sequences that generate leads for his or her firm. After all, LinkedIn is a networking site first and social media second. Our online account enrollment application is secure and safe. An individual will be insured for up to $250,000 for each account type. The ideal result of all prospecting strategies is the same: to convert leads into paying customers or clients. You should contact your legal, tax and/or financial advisors to help answer questions about your specific situation or needs prior to taking any action based upon this information. The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. CRM allows you to track interactions with prospects this includes emails, phone calls, voice mails and face to face meetings. Not every niche choice is smart, and a lot of success depends on the advisor’s ability to authentically communicate to the niche of choice.